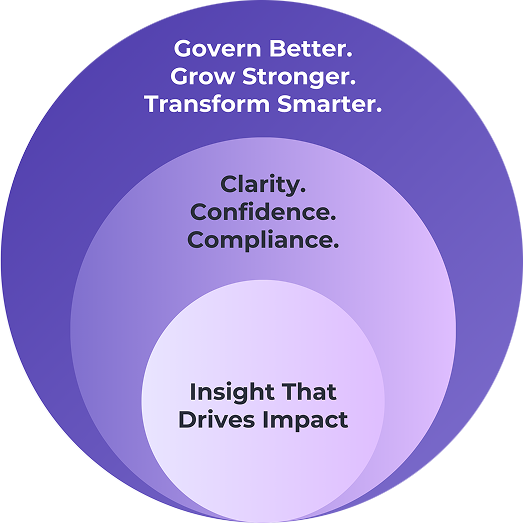

At Insights Global, we deliver expert guidance tailored to Saudi regulations and global best practices. Our team supports your filings, optimizes your tax position, and ensures you stay ahead of evolving ZATCA requirements—all while aligning with Vision 2030’s goals for transparency and business readiness.

From multinational groups to local family businesses, we help you manage risk, maintain trust, and unlock growth.

Strategic Tax Planning & Optimization

Identify efficiencies and opportunities to minimize liabilities within regulatory frameworks.

Transfer Pricing Compliance & Advisory

Ensure accurate documentation and reporting for cross-border transactions.

E-Invoicing Readiness & Support

Align with Saudi Arabia’s e-invoicing mandates with confidence.

Zakat & Tax Health Checks

Assess compliance, identify risks, and recommend improvements.

Tailored Advisory for Industry Needs

Sector-specific solutions for complex challenges.

We partner with organizations to deliver clarity, integrity, and sustainable value—enabling the Kingdom’s transformation goals.

Ready to strengthen compliance and unlock strategic value? Let’s discuss how our Zakat, Tax & VAT Consultancy can support your business goals.

© 2025 Insights Global. All Rights Reserved.